Last Updated on November 21, 2023

Empower the economy while green banking with these 18 Green Banks! Taking your money out of a big bank is one of the most impactful changes you can make! It’s pretty easy and is so incredibly important.

Sixty of the largest banks in the world have invested $3.8 trillion in fossil fuels since the Paris Agreement. Thankfully, green banking helps ensure our money doesn’t continue to contribute to the fossil fuel industry. A sustainable bank doesn’t prioritize profit over people and the planet. These green banks are trying to create a positive impact on their local community, environment, and economy. Keep reading to learn how to bank green and which banks are ethical and eco-friendly.

Table of Contents

Some of the links in this post are affiliate links. For more information please see my disclosure policy.

questioning your current bank

We need to start asking where our money is going. Our savings and checking accounts are being used to fund all sorts of projects, but many banks aren’t transparent about how they’re using our money.

They could be investing in thousands of projects you don’t agree with like drilling, mining, fracking, for-profit prisons, tobacco, pipelines, and so much more. Simply opting for paper-free statements isn’t enough – they need to be putting their money where their values are.

If you don’t know what your bank is doing with your money, maybe it’s time to call them and ask? Investigate your bank. Call them directly and ask how they’re investing.

And, before we go any further, I just want to say this post is purely for educational purposes. I am not a financial advisor, and simply want to share how big banks are funding the climate crisis with the money in your checking accounts, savings accounts, as well as your 401k.

I have a whole post on creating a sustainable 401k plan where you can read more about investing in a sustainable future.

how to bank green

The first step is to find a green bank that fits your needs. Thankfully, I did the hard part for you and have provided information to help you make your decision.

Next, it’s time to break up with your current bank! When you switch your bank be sure to let your bank know that you’re leaving because they’re funding the climate crisis. If they know they’re losing customers over their lending and investment practices, it will affect how they do business.

Look no further than the divest movements impact on the Keystone Pipeline. Move your money and do it loudly. Post on social and tag your bank to let them know why you’re leaving. Leave a comment card or send an email and tell them why!

why choose a green bank?

Green banking is the antithesis of traditional banking. Instead of funding things you don’t agree with like the tobacco industry, for-profit prisons, and yes – the fossil fuel industry, you get to help power a future with renewables.

Ethical banking ensures your money is funding renewable energy initiatives and projects. It’s banking you can feel good about! For more info check out the blog post A Beginner’s Guide to Fossil Fuel Divestment.

which banks are green?

As the divestment movement has grown in popularity, there are more and more green banks opening. The goal is to help local communities and the planet thrive.

Every single one of these banks listed below practices ethical banking. I’ve covered several in the United States, like Aspiration, Ando Money, and City First Bank as well as sustainable banks located in Australia, the UK, and Canada.

RELATED: Are Electric Cars Bad for the Environment?

what is green banking?

Green banking means any form of banking that benefits the environment. They’re mission driven institutions that finance the transition to clean energy and simultaneously fight climate change. They have a triple bottom line where they not only care about what’s in their pockets, but the people and the planet too. Many of these green banks are also B Corporation Certified.

Several of the green banks on this list not only invest in the environmental sector by financing clean energy, but also are powered by it. Many of these banks’ operations are powered by 100% renewable energy, and some even offer green energy home/car loans that make it even easier for their customers to move away from fossil fuels.

which banks are bad for the environment?

The big bad four:

- JP Morgan Chase

- Citibank

- Wells Fargo

- Bank of America

According to the Banking on Climate report, these banks have invested the most money in fossil fuels, and JP Morgan Chase leading the way at $317 billion.

If you have your money with these banks, I highly recommend taking it out. Put it with a local credit union or put it with one of these sustainable banks below.

When I was in high school I had my savings account with Bank of America, and I couldn’t be happier with my decision to leave. It was so EASY!

how does a green bank work?

Eco banking pretty much works like any normal banking process, except the banks involved use their capital *ahem* (the money in your checking and savings) to fund industries that aren’t destroying our planet like:

- local small business loans

- clean renewable energy

- community solar projects

- sustainable farming and agriculture

A few of the banks on the list have brick-and-mortar stores that you can visit in person, but most green banks are exclusively digital. They offer easy to use online platforms and apps, and let you use mobile banking and digital check deposits.

Most of the banks will send you debit or credit cards in the mail and many are made of sustainable materials like wood or recycled plastic.

Personally, I have money with Aspiration and Ando bank (because the APY on their savings accounts are amazing), but Aspiration has a fantastic deal where you can get cash back on some of my favorite brands like girlfriend collective and imperfect produce!

will closing my bank accounts hurt my credit score?

NO! Banks might tell you this to try and get you to stay, but it is absolutely false. Your checking and savings accounts have nothing to do with your credit score. And, you’re simply moving your money from one bank to the next. Here is a great article from Experian on how to safely close your bank account.

18 green banks to power the green economy:

Now that you know about green banking, here are 18 banks that get the Going Zero Waste seal of approval. Each of these banks has a triple bottom line where they factor in people and planet into their business plans. Some are even certified B Corporations.

I’ve organized them into four different regions: America, UK, Canada and Australia. Feel free to jump to whichever section suits your needs.

I’ve also gone ahead and highlighted some key features of each bank, but it isn’t an exhaustive list so be sure to check out their websites for more information.

green banking in the united states:

1. aspiration

- Eco-friendly + ethical initiatives? Aspiration is a certified B Corp, members of 1% for the planet, and donate 10% of their profits. You can plant a tree with every purchase and get up to 10% cash back on Conscience Coalition purchases. They also have 100% fossil fuel free investment and retirement funds.

- Services? Savings + Checking accounts, investing, retirement.

- Availability? Online only, nationwide

/ ASPIRATION /

2. climate first bank

- Eco-friendly + ethical initiatives? Climate First Bank is a Certified B Corp that redeploys customers’ deposits into green initiatives. Employees volunteer at eco events. Sustainable impact report released annually.

- Services? Personal/business banking, solar lending, residential/consumer/commercial lending + cash management

- Availability? Digital banking nationwide, three offices in FL

3. city first bank

- Eco-friendly + ethical initiatives? City First Bank is a B Corp and a Community Development Financial Institution (CDFI), empowering economically distressed communities, and investing in underfunded (often BIPOC) communities through affordable housing, job creation and loaning to those who need it most.

- Services? Personal banking, business/nonprofit lending + checking

- Availability? Nationwide, local branch in Washington, DC

/ CITY FIRST BANK /

4. amalgamated bank

- Eco-friendly + ethical initiatives? Amalgamated Bank is a Certified B Corporation, 100% carbon neutral, and the global leader of the Partnership for Carbon Accounting. They do not invest in fossil fuels and support 100% clean energy.

- Services? Personal banking, commercial banking, institutional investing

- Availability? Nationwide, local branches in NY, CA, + DC

/ AMALGAMATED BANK /

5. spring bank

- Eco-friendly + ethical initiatives? Spring bank is a Certified B Corp, carbon neutral, and a Community Development Financial Institution (CDFI). They seek to help empower economically stressed communities and create equal access to capital.

- Services? Personal banking and lending, nonprofit banking, business checking and loans

- Availability? NYC based

/ SPRING BANK /

6. beneficial state bank

- Eco-friendly + ethical initiatives? Beneficial State Bank is a Certified B Corp and also a CDFI that funds diverse and minority-owned businesses. They’re also a member of Global Alliance for Banking on Values, focusing on improving the quality of life for everyone on the planet including present and future generations.

- Services? Personal banking, business and nonprofit banking

- Availability? Nationwide, local branches in CA, WA + OR

bank green in the uk:

7. the charity bank ltd

- Eco-friendly + ethical initiatives? The Charity Bank is an ethical bank that lends to charities and social enterprises. They’ve given out 59 loans from the environment sector since 2002, and they finance arts, community, education, and social housing.

- Services? Savings and loans

- Availability? Nationwide

/ THE CHARITY BANK /

8. unity trust bank

- Eco-friendly + ethical initiatives? Unity Trust Bank is a socially determined bank – using deposits to fund lending that supports the community. This bank is socially and financially responsible, and offer their employees five paid days a year to do volunteer work in the community. They’re a Carbon Literate Bank achieving a bronze award for improving their carbon footprint.

- Services? Business banking and commercial loans

- Availability? Nationwide

/ UNITY TRUST BANK /

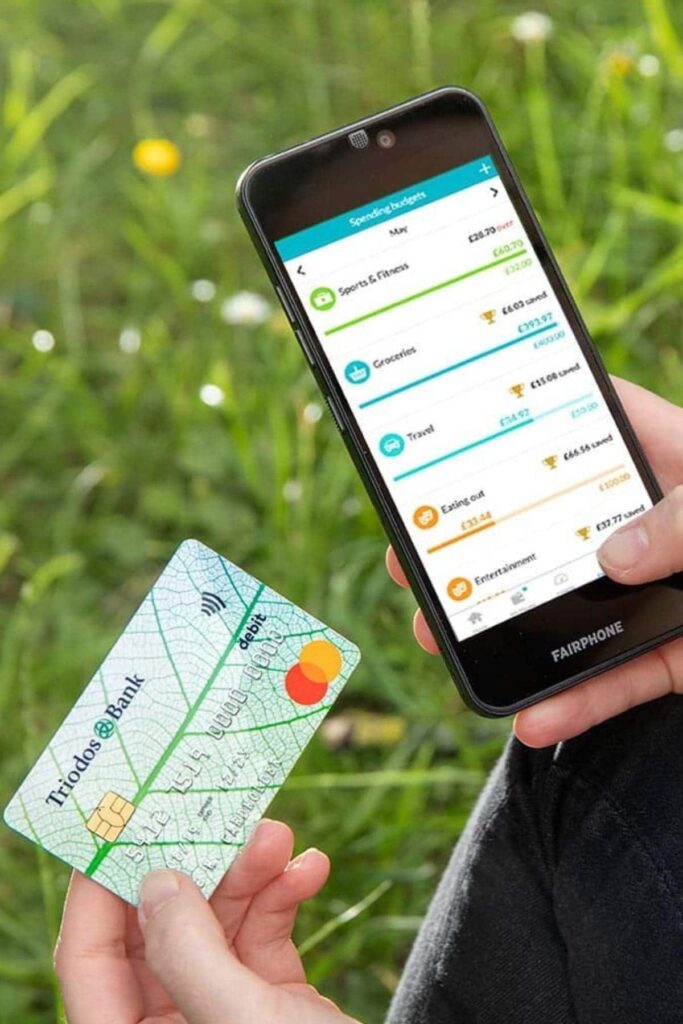

9. triodos bank uk

- Eco-friendly + ethical initiatives? Triodos Bank is a Certified B Corp. They put money towards renewable energy firms, socials housing, organic farming, as well as social enterprises and charities. They’re also partners with the Soil Association, Ecotricity and the RSPB.

- Services? Personal banking, business banking, and charity banking

- Availability? Nationwide

/ TRIODOS BANK /

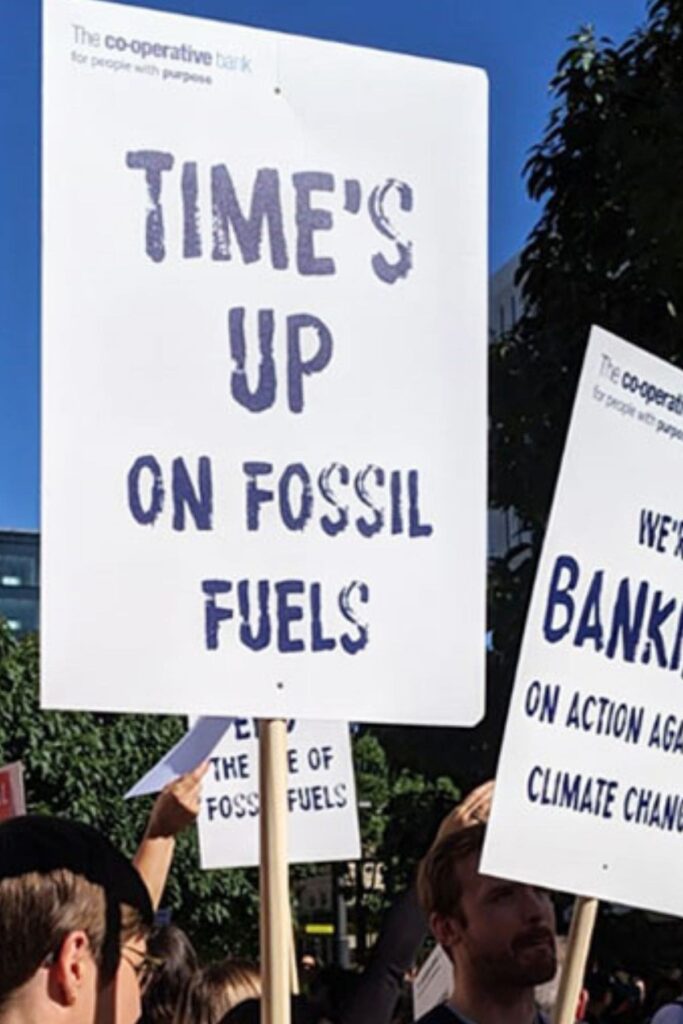

10. co-operative bank

- Eco-friendly + ethical initiatives? Co-Operative Bank is carbon neutral, zero waste to landfill, source all their electricity from renewable energy. They have a Value & Ethics poll where you can voice your views on important issues such as climate change, human rights, animal welfare, etc. which determines the campaigns they support, and their ethical policy.

- Services? Savings, mortgage, loans, credit cards, insurance, and business lending

- Availability? Nationwide

11. starling bank

- Eco-friendly + ethical initiatives? Starling Bank is branchless, paperless and run on renewable energy, and they’ve pledged to become a NetZero company. Employees are allowed 16 hours paid leave per year to do volunteer work. They will never provide banking services to organizations that use excessive power to promote harmful behavior to individuals, groups, or society as a whole.

- Services? Personal and business banking

- Availability? Nationwide

/ STARLING BANK /

ethical banking in canada:

12. omista credit union

- Eco-friendly + ethical initiatives? OMISTA Credit Union bank is a B Certified Corp committed to the betterment of their community. Profits are reinvested locally, and they’re Bullfrog Powdered, meaning they choose 100% renewable energy for part of their operations, and offset 100% of their electricity use with green energy.

- Services? Personal and business banking

- Availability? Nationwide, online banking options

13. nbta credit union in new brunswick

- Eco-friendly + ethical initiatives? This B-Corp and full-service Credit Union, and 100% member-owned since 1971. They service, volunteer and donate to local entities like Canadian Blood Services, Food Banks, Breakfast Programs, Flood Relief and more. They’re Bullfrog Powered too, which is Canada’s leading green energy provider.

- Services? Personal and business banking, investment banking, credit cards, wealth management services

- Availability? New Brunswick based

14. cibc

- Eco-friendly + ethical initiatives? CIBC bank focuses on environmental, social and governance matters of importance to their stakeholders. In 2020, they financed $15.7 billion in the environmental and sustainable sector, and helped fund community-based renewable energy projects across Canada through their contract with Bullfrog Power.

- Services? Personal, small business and commercial banking, credit cards, insurance, investment banking

- Availability? Nationwide, online banking and USA options

/ CIBC /

eco banking in australia:

15. bank australia

- Eco-friendly + ethical initiatives? Bank Australia is a B Corp and customer-owned bank. They’re run on 100% renewable electricity and carbon neutral. As a member, you’re also a part of their Conservation Reserve where they help wildlife adapt to climate change, provide habitat for native species and work to help biodiversity. Pictured (left) is a red-tailed black cockatoo that lives on the Conservation Reserve.

- Services? Personal and business banking

- Availability? Nationwide, online and mobile banking options

/ BANK AUSTRALIA /

16. commonwealth bank

- Eco-friendly + ethical initiatives? Commonwealth Bank is committed to the transition to net zero emissions. Their CommBank Green Loan is a 10-year secured fixed rate loan designed for existing and eligible home loan customers to buy and install clean energy products like solar panels, and they’ve partnered with Amber to give their customers access to renewable energy.

- Services? Personal and business banking, home loans, investment banking, insurance and institutional banking

- Availability? Nationwide and multinational, online and mobile banking options

17. bendigo bank

- Eco-friendly + ethical initiatives? Bendigo Bank is an ESG which means they approach topics concerning the environment, society and corporate governance with transparency and accountability. This bank seeks to be climate neutral by 2030. They’ve been offering green loans since 2002 that help customers lower their carbon footprint, and they’ve provided funding to several community renewable energy projects such as Hepburn Wind and Warburton Hydro.

- Services? Personal and business banking, loans, investments, insurance, credit cards

- Availability? Nationwide, online banking options

/ BENDIGO BANK /

18. teachers mutual bank limited

- Eco-friendly + ethical initiatives? Teachers Mutual Bank is dedicated to helping Australian education sector and their families secure their financial futures. An ethical, community driven bank that runs on 100% solar power and never lends money to the fossil fuel industry. They also have a Responsible Investment Association Australasia (RIAA) Certification, and return 6.8% of their profits to the bank’s members and the education community.

- Services? Personal banking, home and personal loans, credit cards, insurance, travel

- Availability? Nationwide, online and mobile banking options

Which of these green banks would you try? List your favorite green banking methods in the comments below.

Clean Energy Credit Union is an incredible green bank too! They are a non-profit that strictly does clean energy loans. Their mission is to make clean energy available to all and CUNA designates them as a low-moderate income credit union.

Thank you for this article, it has been super helpful for finding ways to divest from years of Bank of America accounts. It looks like Amalgamated and City First both offer small business accounts so I’ll definitely be contacting them to do more research! Love your actionable articles!

Thanks for this list; just opened a new account!

I think you have a mistake for the omista credit union as I need to be a resident of New Brunswick to become a member so it’s not national wide. Kinda sucks that Canada doesn’t have an good green banks.